Members can purchase a used car from Enterprise and finance it through MCU. The Prime Rate is usually adjusted at the same time and in correlation with the adjustments of the Fed Funds Rate. MCU partners with Enterprise Car Sales to offer members great deals on their next vehicle purchase. Adjustments to the prime rate are made at the same time although, the rate does not adjust on any regular basis. The rate is almost always the same amongst major banks and credit unions. The Prime Interest Rate is the interest rate charged by banks to their most creditworthy customers (usually the most prominent and stable business customers). Please consult your tax advisor regarding the deductibility of interest. The rate is subject to change January 1st and July 1st each year.

The listed rate is for excellent credit, your rate may vary based on your credit score. * The interest rate is determined by adding a margin to the prime rate. Loan applications subject to METRO’s lending guidelines. If you qualify, we can finance up 90% with added premium, ask our loan department for more details. Loan-To-Value (LTV) Generally we will finance up 85% of your homes value. MORTGAGE / HOME EQUITY LOAN RATES (Rates Effective ) Rates As Low As Loan Type Rates not available to refinance existing METRO loans. *Rates listed are based on credit history, amount financed and includes automatic payment discount of. If you’re looking to consolidate debt, pay for unexpected repairs, make a large purchase, or pay for that dream vacation, we offer great rates, flexible terms and convenient repayment options. SIGNATURE (PERSONAL) LOAN RATES (Rates Effective 5701/2019) The minimum loan amount is $20,000 for 72 & 84 months terms. Best Renewable Energy Controllers based on Customer Support, Controls and Functionality, Value for Money, Durability. Up to 125% financing available with an added premium. EPEVER MPPT Solar Charge Controller 30A 12V 24V Auto, Solar Charge Controller Max 100V Input Negative Grounded Solar Regulator, for Lead-Acid and Lithium Batteries Visit the EPEVER Store. Financing is 80% of the purchase price for new vehicles and 80% of the NADA/Kelly Blue Book retail value for used vehicles.

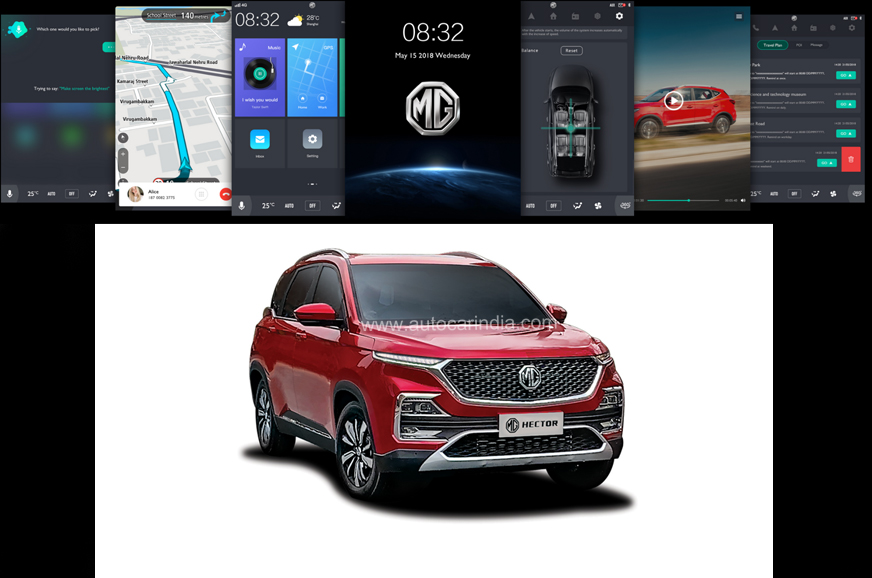

We offer quick pre-approvals and a streamlined application process, so you can get on the road fast! VEHICLE LOANS (Rates Effective 01/01/20) Purchase a new or used auto with competitive financing from Metro. Just use our online loan application to apply anytime 24/7! It’s fast, convenient, safe, and secure.

0 kommentar(er)

0 kommentar(er)